Table of Contents

Your Financial Future Starts Today

‘In the midst of every crisis, lies great opportunity’ | by Helix Legal

You work too hard to let your money control you! Why not learn to master your money (instead of letting it master you)? That’s exactly what we’re doing today!

In this post, you will find 8 awesome ways to regain control over your financial health, plenty of powerful tips to achieve your financial goals faster, and free worksheets that will help you master your money like a PRO.

PS. The number of FREEBIES will blow your mind!

1. Evaluate Your Financial Health

The first step in regaining control of your finances is to evaluate your current financial situation. Because without knowing exactly where you stand with your finances you won’t be able to make important improvements. Not to mention reaching your financial goals. So instead of ignoring your finances and leaving them to chance hoping that somehow your financial situation would improve itself, you should take matters into your own hands.

While evaluating your personal financial status can be tough especially if you’ve never done it before with the right strategic approach, it can become quite easy and much less stressful than you might think. And to help you with that here are 5 simple steps to diagnose your financial health:

- Calculate your net worth here

- Calculate your monthly debt-to-income ratio here

- Evaluate your housing situation

- Calculate monthly income and expenses

- Evaluate your savings

- Check your credit reports (get your credit report for free at annualcreditreport.com.)

- Analyze your investments

2. Increase Your Financial IQ

The money goals you set for yourself, the financial decisions you make on a daily basis, your current investment plan, or even how you budget your money – it all depends on your ability to understand and effectively use essential financial skills. In other words, the more you know about finances the better you are at managing your money.

So take advantage of the Informational Era we live in and start increasing your financial literacy without leaving your home the easy way, via the Internet. Read, listen, watch high-quality content on personal finances and start applying what you’ve learned to not only improve your financial wellbeing but also to avoid financial problems that you had in the past.

Best Resources On Personal Finance In 2021

- Personal Finance Books

- Rich Dad Poor Dad by Robert Kiyosaki

- Rich Dad’s CASHFLOW Quadrant: Rich Dad’s Guide to Financial Freedom by Robert T. Kiyosaki

- The Richest Man in Babylon Paperback by George S. Clason

- The Bogleheads’ Guide to Investing by Mel Lindauer

- The intelligent investor by Brando Graham

- Think and Grow Rich: The Landmark Bestseller Now Revised and Updated for the 21st Century by Napoleon Hill

- Magic of Thinking Big by David J. Schwartz

- Your Money or Your Life: 9 Steps to Transforming Your Relationship with Money by Vicki Robin

- You Are a Badass at Making Money: Master the Mindset of Wealth by Jen Sincero

- The Total Money Makeover Workbook by Dave Ramsey

- The 4-Hour Work Week: Escape the 9-5, Live Anywhere and Join the New Rich by Tim Ferriss

- The Millionaire Next Door: The Surprising Secrets of America’s Wealthy by Thomas J. Stanley

- I Will Teach You to Be Rich, Second Edition: No Guilt. No Excuses. No BS. Just a 6-Week Program That Works by Ramit Sethi

- The Total Money Makeover: Classic Edition: A Proven Plan for Financial Fitness by Dave Ramsey

- Start Your Own Corporation: Why the Rich Own Their Own Companies and Everyone Else Works for Them by Garrett Sutton

- Youtube Channels

- Bloomberg TV Markets and Finance

- MoneyTalks News

- GoldSilver (w/ Mike Maloney)

- Bigger Pockets

- The Financial Diet

- SeedTime Money

- Podcasts

- Financial Times – Banking Weekly

- Morgan Stanley Ideas Podcast

- Bloomberg Masters in Business Podcast

- Bloomberg P&L

- Exchanges at Goldman Sachs

- Financial Times News Briefing

- Financial Modeling Podcast

- Motley Fool Money

- Blogs on Business & Personal Finance

- Financial Samurai

- I Will Teach You to Be Rich

- Business Insider

- Real-Time Economics

- Freakonomics

- The Consumerist

- Calculated Risk

- The Conscience of a Liberal

- Board games

- Cashflow

- Monopoly

3. Budget Your Money

Budgeting is a fancy term for developing a strategic plan for your money. It’s a simple but extremely effective method of keeping a track of how much money you earn and how much money you spend on assets and liabilities you own.

Anybody who has ever tried budgeting knows it’s the best and easiest way to stay on top of their finances, organize their spending, track their short and long-term financial goals and of course, avoid debt. So if you haven’t been budgeting your money in the past, you probably have no idea of how much money do you actually earn and spend each month. If that’s your case, no wonder you feel confused about money.

With that being said, it’s not too late for you to overcome this confusion and start budgeting your money. And to help you with that I created an Excel template that you can get for free here)

4. Set Realistic But Challenging Financial Goals

Setting clear financial goals means taking full responsibility for your financial life and being mentally prepared to challenge yourself to achieve the desired results.

This process of setting clear financial goals will not only help you to redirect your focus on what’s truly important and what should be done in order to improve your financial life but also will help you to regain full control over your personal finance. So grab your FREE SMART financial goals worksheet, read 6 steps to setting SMART goals, and set your financial goals TODAY!

6 Steps To Setting SMART Financial Goals

- Think about SMART financial goals you could set for yourself today

- Prioritize & Simplify (to develop laser-like focus)

- Get super clear on your financial goals

- Write your financial goals down

- Map Up the Actions you Need to Take

- Break the big financial goal into small achievable steps to avoid being overwhelmed

- Approach every goal systematically

- Track your progress

- Plan for Obstacles in Advance (what are your fears?)

- Imagine a worst-case scenario (think about what can go wrong and prepare yourself)

- Set Up Your Environment to Naturally Breed your Financial Goals

- Surround yourself with like-minded people that will support you and motivate you in your journey to achieving your financial goals

”You are the average of the five people you spend the most time with.” - Jim Rohn

- Be proactive and create opportunities to meet your goals

- Consider apps for saving and budgeting

- Put your Financial Goals into Autopilot

- Create habits that push you towards your financial goals

- Decide what percentage (at least 20%) of your income should go towards savings every single month

- Automate Your Savings - set up an automatic deposit for your savings account from a checking account or another deposit account

- Practice self-discipline and self-control

5. Prepare For A Future

As we begin to move past what was a challenging year for all of us, I am thinking a lot about preparedness - how I can be more prepared for the unexpected.

Preparing for a future looks a bit different for everyone.

Imagine if you had the tools to prepare for your future, to find your financial stride, and leave the stress of financial worries behind?

That’s why I am so excited about this collection of resources to meet you wherever you are in your journey for financial wellness.

It’s called The Master Your Money Super Bundle and it was created and curated by people who have learned how to manage their finances and thrive (without large inheritances or winning the lottery). And they’ve brought it back for just 2 days.

While their incomes and expenses are all over the spectrum, you can count on real-life, money-saving strategies from people who know what it’s like to live in expensive areas, or have large families, or enjoy the little extras (even on a tight budget).

They want to help you pay off debt, create a budget for REAL life, and reach your financial goals.

When you buy the Master Your Money Super Bundle you’ll get access to:

- 9 eBooks

- 27 eCourses

- 15 Printables

- 6 BONUSES worth $454.95

This curated collection of 51 resources for $67 to help you in:

- Debt Management (6 resources worth $302.48)

- Family Finances (8 resources worth $424.92)

- Increasing Income (6 resources worth $484.00)

- Investing (4 resources worth $600.99)

- Money Mindset (7 resources worth $723.96)

- Saving (10 resources worth $271.00)

- Tracking & Organization (9 resources worth $217.44)

And because Ultimate Bundles offers a 30-Day Happiness Guarantee, you can try the bundle with no risk!

In the Bundle: 6 BONUSES Worth $454.95

1.*EARLY BIRD* Guided Journal from Her Money Journey worth $20.00

A personal finance blog committed to helping women of color navigate their money journey, and create a comfortable space to learn and grow. All women are welcome to join the journey.

2. It’$ My Money Journal from P. Dixon Consulting, LLC worth $14.95

Dixon Consulting provides financial coaching and education workshops and resources to individuals of all ages. Most are done under it’s trademark brand It’$ My Money®.

3. 14 day extended trial membership from WalletWin LLC worth $99.00

WalletWin is a personal finance company that helps young professionals and families gain control of their money so they can get out of debt, save, and change the world through generosity. Most people were never taught how to handle their money, resulting in money tension and financial stress as the backdrop of their lives. WalletWin helps everyday people (regardless of their income) turn money from a source of worry into a source of peace.

4. 60-day access to W.I.S.E. Financial Fitness Level 4 from Pocket of Money worth $50.00

Pocket of Money provides information and resources for individuals and businesses ready to make significant progress towards financial success. This is achieved with consulting, courses, training, and resources that help others take control of their money.

5. 3 Month Membership of the Smart Side Hustle Society from SilverPeak Development worth $150.00

The Smart Side Hustle Society helps career professionals create and scale Side Hustles that complement their day job, supplement their income and don’t compromise their lifestyle. SilverPeak Development supports clients through coaching, memberships, and our podcast, the Got Side Hustle show.

6. 3 Months Free Access to the Financial Success Society Membership from Making Cents Count worth $141.00

Making Cents Count guides and educates high-achieving women with organizing their finances and building customized investment strategies so they feel confident about a secure financial future.

6. Spend Money Wisely

Oftentimes we buy something without much thought. We make a purchase after seeing or hearing an advertisement on TV, online, or on social media and we feel we have to have it. We buy IT not because we need it, but because we want it.

“We buy things we don’t need with money we don’t have to impress people we don’t like.” Why do we do it? Well, probably because we want to be live happy without doing any work. So we search for quick fixes for complex problems instead of addressing the issue appropriately.

Before the social media era being intentional with spendings was a bit easier. We weren’t surrounded by advertising. Now it’s different. Now, it’s important to be vigilant and almost immune to advertising. Otherwise, the fear of missing out will cost the trust a fortune.

The solution to that is to simplify your spending and be more intentional with your shopping. And what better way to do that than by creating a “to-buy” intentional spending list?

- Create a “to-buy” intentional spending list

- Put items you want to buy on this list

- Ask yourself if you are spending in line with my values

- Ask yourself how a certain product or service will improve the quality of your life

- Ask yourself what are the alternative options (borrowing or buying second-hand)

- Before you make a purchase wait at least 7 days and if you still feel like the purchase is a necessity, buy it

7. Advance In Career

Whether you have a steady 9 to 5 job that you like or you’re building your own brand, improving your career prospects should always be one of your top priorities in life. Focusing on doing your job well is crucial if you want to be seen as a person with a strong work ethic. But keeping your professional development continuous is even more important for at least two reasons.

First, we can never predict how the economy will work, therefore having more options provides a guarantee for a financially stable future. And the second reason why you should give your career a boost is that “progress equals happiness”, more opportunities, more money, and more stability in life. And isn’t that what we all search for?

So if you want to advance your career and you need some help to do this I wrote a post titled “6 Powerful Steps To Boost Your Career In 2021” that you can read here

8. Manage Lifestyle Inflation

Lifestyle inflation also called lifestyle creep refers to the phenomenon when spending increases as an individual’s income goes up. Suddenly, non-essential items are perceived as basic needs such as a new car, bigger apartment, luxury goods. In other words, needs are confused with wants and people instead of saving more money and investing in assets spend more on liabilities. In consequence, building lasting wealth become impossible.

At first glance, it seems harmless. But lifestyle inflation is a trap of thinking that the more you earn the more you should spend on living expenses. That is simply untrue, because how can you improve your financial situation if you spend money like there’s no tomorrow? The answer is: you cannot. That’s why there are so many people who have a well-paid job and still, they are constantly broke or in debt.

As there’s nothing wrong in seeking to improve standards of living as an individual’s income goes up, money isn’t just for spending. Money, if used wisely becomes a powerful tool for reaching your (not only financial) goals and building a financially stable future.

"The Laws Of Goal Setting Universe: The Formula For Success In Setting & Achieving Goals"

“The Laws of Goal Setting Universe” Workbook: The Formula For Success In Setting & Achieving Goals” is a 100-page workbook designed to help you create a crystal clear vision of your future, set the right goals (in alignment with your vision and purpose), create a successful mindset, and develop smart tactics (habits, routines, rituals) that will help you achieve your objectives faster and more easily.

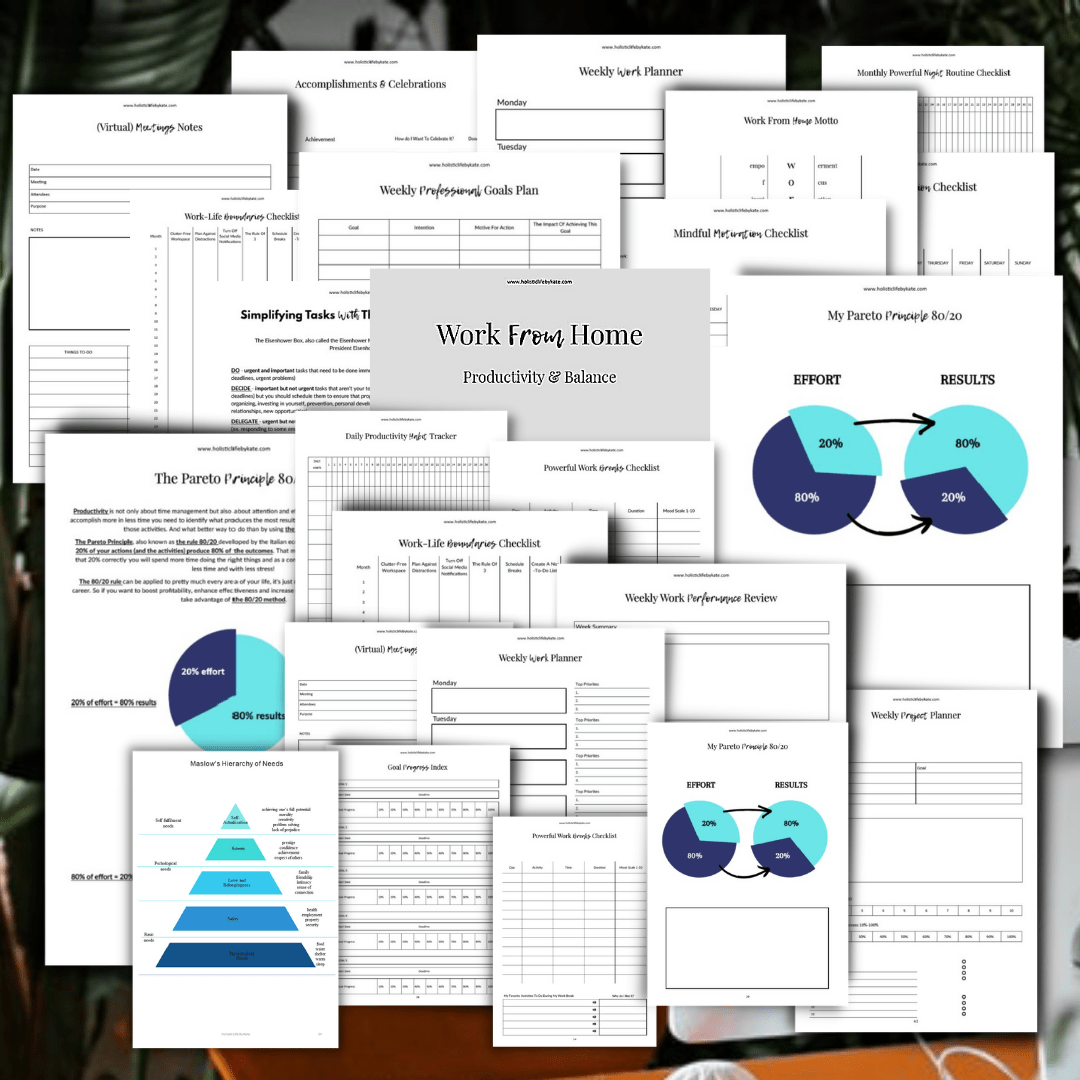

Grab Your Free Printable Workbooks

Posts On Living Your Best Life

- How To Upgrade Your Life For Maximum Results & Happiness

- How To Figure Out What You Want In Life: 12 Simple Exercises

- Discover 10 simple ways to train your self-discipline muscle

- Use best time management apps to keep you on schedule at work

- Organize your day around your goals

- Use the Eisenhower Box to identify your top priorities and avoid the urgency trap

- Create and maintain a powerful morning routine

- Develop morning rituals to make your motivation flow effortlessly

- Create motivation through action

- Start before you are ready

- Improve your decision-making process

- Overcome your self-limiting beliefs that block your progress

- Balance productivity and happiness

- Cultivate self-care routine

- The 3 x 8 rule for Perfectly Balanced Day & Life

- Create rituals to induce a flow state

Stay positive

Be Mindful

and

Master Your Money!

xo Kate

2 thoughts on “8 Simple Ways to Take Control of Your Finances Today + Freebies!”

thanks for info

You are welcome!! Have a great rest of the week!! 😃😉